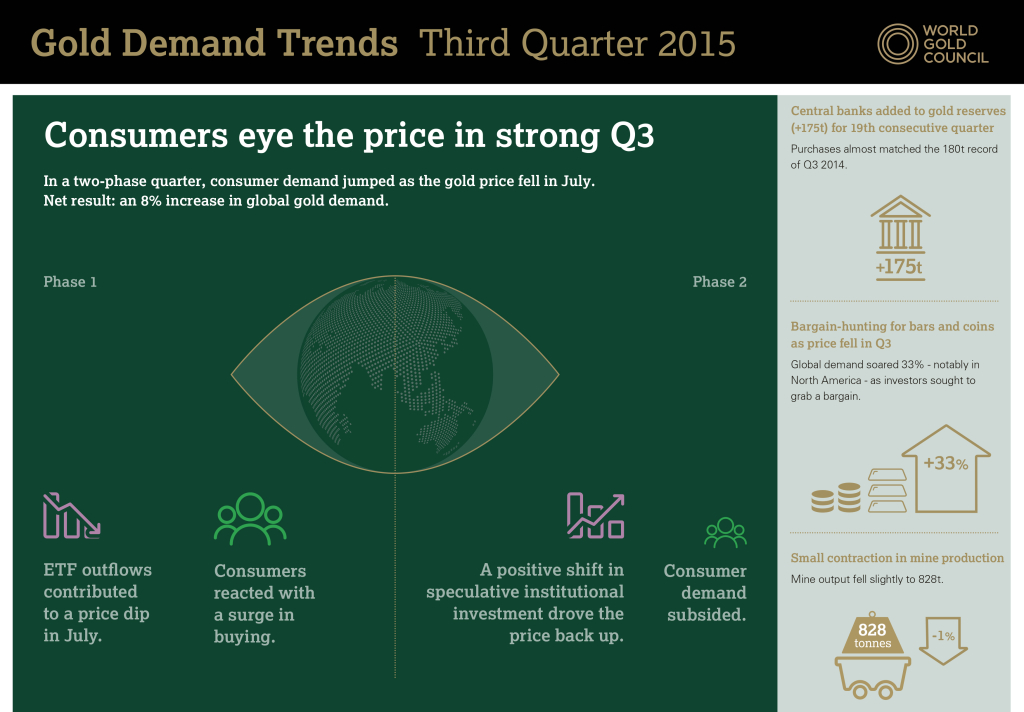

World Council – Gold Price Demand Trends Spike, Will It Hold?

Gold is appearing to recover from the US Financial Crisis, but is it permanent?

Source: gold.org

Some of the key findings from the report are as follows:

- Overall demand increased by 8% year-on-year to 1,121t as a number of factors, including ETF outflows, contributed to a price dip which buoyed consumer demand around the world.

- Total consumer demand – made up of jewellery demand and coin and bar demand – totalled 928t, up 14%.

- Global investment demand saw a significant rise of 27% to 230t, up from 181t in Q3 2014. This was led by the US which saw a surge in bar and coin demand, up 207% to 33t from 11t on the same period last year, with support from China, up 70% to 52t and Europe up 35% to 61t.

- Global jewellery demand for Q3 2015 was up 6% year-on-year to 632t compared to 594t in Q3 2014. In India, demand was up 15% to 211t and China was up 4% to 188t. The US and the Middle East also saw gains, up 2% to 26t and 8% to 56t respectively.

- Central bank demand reached 175t, the 19th consecutive quarter of net purchases.